Key takeaways

- April saw a slight drop in discount rates as Treasury yields increased at the very short end but decreased at the long end while credit spreads narrowed slightly.

- Global equity market returns were mixed with large cap developed markets posting positive returns and emerging markets as well as mid and small caps reported negative returns; however, fixed income markets were generally positive.

- Pension plan funded status improved for those with meaningful allocations to large cap developed market equities. Plans with large allocations to emerging market stocks or small caps could have actually seen funding levels decline.

April 2023 summary

Volatility decreased during the month, thanks to easing worries about regional banks and better-than-expected Q1 earnings. The job market remained strong, with U.S. companies adding 296,000 jobs in April, up from 142,000 in March, although initial jobless claims rose modestly.

Even with the decrease in volatility, the market remained risk-off. As a result, large-cap stocks in developed markets did well last month, but emerging markets struggled. Large cap saw positive returns while mid and small caps lost ground.

The Treasury yield curve steepened slightly, with very short-term interest rates increasing and long-term bond yields decreasing. Credit spreads narrowed as stresses in the market eased. These changes were positive for bond market returns but resulted in a slight decline in discount rates which increased liabilities.

For pension plans, funded status should have improved a bit for those with meaningful allocations to large cap developed market equities. Those plans with more meaningful allocations to emerging market stocks or small caps could have seen funding levels actually decrease.

As we look ahead, while the market expected the Fed to raise interest rates again in early May (which it did), there is little agreement about what the rest of the year will hold. Meanwhile, the U.S. House of Representatives passed a debt-ceiling bill in an effort to avoid a government shutdown, but the bill moves to the Senate where passage will be more difficult. With this political uncertainty on the horizon, we anticipate more market volatility that will cause pension funded status to fluctuate as well.

Discount rates & asset returns

FTSE pension discount rate index last 12 months

Discount rates stayed fairly level in April, dropping less than 0.05%, with the FTSE pension discount curve finishing the month at 4.76%. The FTSE curve stayed fairly consistent throughout the first four months of 2023 in comparison to the large fluctuations experienced throughout 2022.

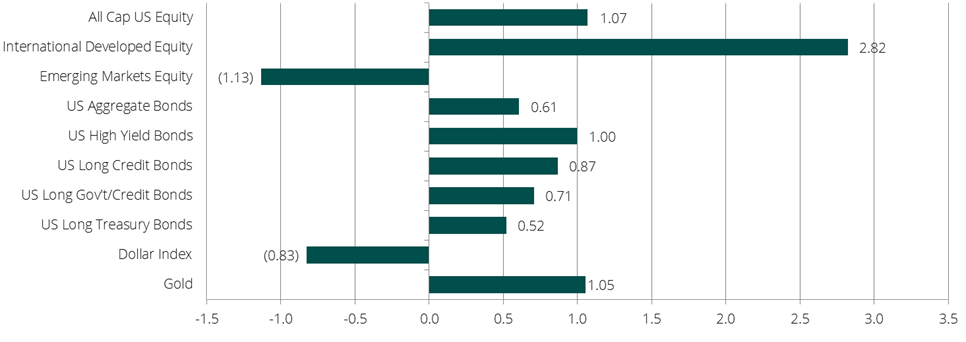

April 2023 investment returns (%)

US equities had a positive month in April as market volatility from the regional bank stresses started to ease off. The preliminary first quarter GDP growth came in lower than expected with most of the slowdown being due to an inventory drag. Consensus had been building that the Fed would raise rates once again by 0.25% to 5.25% (which it did on May 3rd). Fixed income had another positive month with high yield bonds returning 1%. Credit spreads generally narrowed over the month besides emerging market debt modestly widening. Oil and gold prices both rose around 1.5% in April with oil ending at $77 per barrel and gold ending at $2,018.